|

||

|

In this update:

Harrisburg Highlights: Tracy TalkSenator Pennycuick Appointed to State Council on the Interstate Compact on Educational Opportunity for Military ChildrenThis week, Senator Tracy Pennycuick (R-24) was appointed to State Council on the Interstate Compact on Educational Opportunities for Military Children, for a term of four years. Term ending November 30, 2027. The purpose of this compact is to reduce and remove educational and emotional barriers imposed on children of active-duty military families, because of the frequent moves and deployment of their parents. All 50 states, including the District of Columbia, are working together to provide a consistent set of policies that will make getting started in a new school, joining extracurricular activities and meeting graduation requirements as easy as possible for military children. “Having young children during the time of my service has given me firsthand experience in this matter”, Senator Pennycuick said. “The transition for my family was never easy. It is an honor to now bring my personal experiences and those of my children, to the table, and ensure stability and a smooth transition within these children’s lives. Because they too are making a sacrifice.” Appointment to the board coincides with Sen. Pennycuick’s recently introduced Senate Bill 209, which would extend coverage of the Interstate Compact to children of Pennsylvania National Guard and Reservist members. Pennsylvania joined the Interstate Compact in 2012 (Act 6). The goal of this compact to provide as much consistency as possible with other states relative to school policies and procedures, while honoring the current laws that administer public education in our state. Disabled American Veterans (DAV)Joined with me last week was DAV’s Chapter 10 Pa. Legislative Chairman Adjutant, Lee Horowitz, and disabled Marine Vietnam Combat Veteran, James Ulinski. Disabled American Veterans (DAV) is an organization of Veterans that help other Veterans. They not only advocate for Veterans everywhere, but they provide a lifetime of support. We thank you for your selfless service to our country. To learn more about DAV, or to volunteer, visit their website at: https://www.dav.org/ Changes to Social Security Income and Impact on SNAP EligibilityThe 2023 cost of living adjustment for Social Security Income (SSI) recipients set by the federal government prompted an 8.7 percent increase to SSI income. However, eligibility thresholds for SNAP – which are determined by the federal government – did not rise proportionally. DHS is determining the scope of ineligibility, but estimates that 5,000-20,000 SNAP households will be disenrolled from SNAP due to ineligibility because of the SSI COLA income increase. For these cases, January will be the final month of eligibility and cases will close for February. DHS will share final figures when they are available in early February. Additionally, approximately 249,000 households will experience a decrease in their monthly SNAP benefit. The average reduction in benefits will be $40 per household, which will take effect in March 2023 following the end of COVID-19 SNAP Emergency Allotments. Notices of closure or changed benefits will be sent to households, and given the overlap with SSI eligibility, DHS anticipates that this impact will be felt most by seniors and older Pennsylvanians. DHS is working to communicate via mail to these households outlining where they can find food assistance in their community and outlining how to enroll in programs targeted towards seniors if they are not already accessing these resources. End of SNAP Emergency AllotmentsSince the pandemic started in 2020, households receiving SNAP benefits have been getting an additional payment in the second half of the month known as an Emergency Allotment (EA). These payments brought households to the maximum monthly payment for their household size or, if they are already receiving the maximum, they received a $95 EA. The Federal Consolidated Appropriations Act of 2023 ends states’ authority to issue EAs after February 2023. This means that starting in March 2023, SNAP households will receive just one monthly SNAP payment, reducing federal food assistance and reducing income to SNAP grocers and food retailers by more than $200 million statewide. This will affect Pennsylvania’s entire SNAP population – 1.94 million Pennsylvanians as of December 2022. Individuals must keep their case information up-to-date and report any changes to their income, expenses, and/or household size. Monthly SNAP benefits can be adjusted if households report:

SNAP recipients who know they have had changes to the number of people in their household, income, or expenses should report any changes at:

This will help ensure households are receiving the full SNAP benefit they are eligible to receive. Assistance Available to People Experiencing Food Insecurity or Additional HardshipPennsylvanians can call 211 or visit www.pa211.org to connect with various local food resources. They can also visit www.feedingpa.org to find local food banks and other food assistance programs. DHS and the Pennsylvania Department of Agriculture have also organized information about food assistance programs on their websites. Go to www.dhs.pa.gov/ending-hunger and www.agriculture.pa.gov/foodinsecurity for information on assistance programs and other resources. For households with children SNAP recipients who are pregnant or have children under 5 may be able to get help buying food from PA WIC. You can call 1-800-WIC-WINS or apply online at www.pawic.com. For seniors The Senior Farmers’ Market Nutrition Program provides eligible seniors with vouchers redeemable at more than 800 farm stands and more than 200 farmers’ markets in Pennsylvania. The Senior Food Box Program can also provide eligible seniors with additional shelf-stable groceries. Learn more about these programs from the Pennsylvania Department of Agriculture. More information on these changes can be found at www.dhs.pa.gov/SNAP. Voter ID: Time for PA to Catch Up with Other States, Nations

A proposed constitutional amendment passed by the Senate earlier this month to require ID verification at polling places remains in the House of Representatives. Its approval is needed to let voters have a say through a ballot question in the spring primary election. Pennsylvania’s failure to enact this key component of election integrity has put it behind not only a vast majority of states and most developed countries, but behind many developing nations as well. Every excuse used to block this rational election reform has been shown to be false. Requiring proof of identification before voting does not suppress turnout, and acceptable IDs are not difficult to obtain. Nationally, the calls for voter ID come from Democrats and Republicans alike. Eighty percent of Americans favor voter ID as do 74% of Pennsylvanians. Now is the time to pass Senate Bill 1 and let the voters decide. Restoring Checks and Balances in Pennsylvania Government

In addition to letting citizens decide whether voters should be required to show ID, Senate Bill 1 includes a proposed constitutional amendment allowing the people’s representatives in the General Assembly to overturn any government regulation that conflicts with the will of the people. The need for this change was made clear by the Wolf administration’s unilateral decisions during the pandemic, closing businesses and schools with no input from the people. Despite the clear design of our government with three co-equal parts, the executive branch elevated itself above the legislative and judicial branches in an obvious violation of the checks and balances afforded by the Pennsylvania Constitution. No governor of any party should be permitted to wield such unchecked power again. If the House of Representatives follows the Senate’s lead and passes Senate Bill 1, voters will be empowered to restore this crucial balance of power. Phase-out of Job-Killing PA Tax Begins

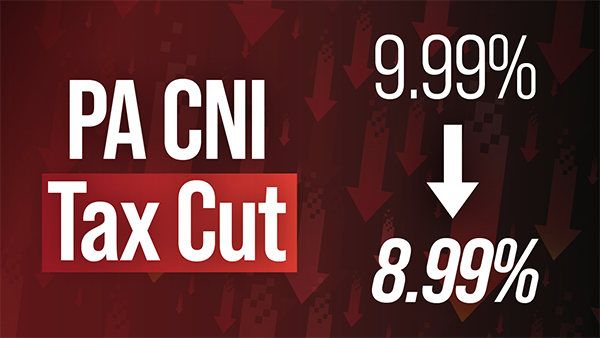

The phase-out of Pennsylvania’s sky-high Corporate Net Income tax got underway this month, part of our efforts to keep good jobs here and create new ones. Republican lawmakers secured a cut in this job-killing tax as part of the 2022-23 state budget. Before this reduction to 8.99%, Pennsylvania’s CNI tax had been 9.99% for nearly three decades while other states had lower tax rates – some far lower – and many have been lower for almost as long. When gradually reduced to 4.99% in 2031, Pennsylvania’s CNI rate will have gone from one of the highest in the nation to one of the lowest, making the commonwealth far more competitive with other states. A 2009 report by an economist at the Federal Reserve Bank of Kansas City demonstrates that the burden of the corporate income tax is borne in large part by labor within the state in the form of lower wages. A 2016 paper published in the journal American Economic Review found employees shoulder about a third of the corporate tax burden. Reducing this tax will be the difference between jobs coming to our local communities and jobs leaving. This will be a great benefit to Pennsylvania families. Rebates for Property Taxes and Rent Available to Seniors, Pennsylvanians with Disabilities

Older adults and Pennsylvanians with disabilities can apply now for rebates on property taxes or rent paid in 2022. The rebate program benefits eligible Pennsylvanians age 65 and older; widows and widowers age 50 and older; and people with disabilities age 18 and older. The income limit is $35,000 a year for homeowners and $15,000 annually for renters, and half of Social Security income is excluded. Spouses, personal representatives or estates may also file rebate claims on behalf of claimants who lived at least one day in the claim year and meet all other eligibility criteria. The maximum standard rebate is $650, but supplemental rebates for qualifying homeowners can boost rebates to $975. You can find more eligibility and application information here. Eligible applicants can visit mypath.pa.gov to electronically submit their applications. Local Organizations Can Apply Now for Conservation Grants

Counties, municipalities and municipal agencies, pre-qualified land trusts, nonprofits and other eligible organizations can apply now for state conservation, recreation, trail and related grants. Administered by the Department of Conservation and Natural Resources, the Community Conservation Partnerships Program is funded with a variety of state and federal funding sources including Pennsylvania’s natural gas Impact Fee. Applications will be accepted through April 5. Online tutorials are available to aid organizations in the application process. Lowering the Risk of Birth Defects

Rates of infant deaths due to birth defects have declined by 10% in the United States. However, even today, every 4½ minutes a baby is born with a major problem affecting parts of the body including the heart, brain or foot, causing lifelong health challenges. The National Birth Defects Prevention Network offers women five tips for preventing birth defects:

Not all birth defects can be prevented. However, healthy choices and habits help lower the risk of having a baby born with these challenges. |

||

|

||

Want to change how you receive these emails? 2026 © Senate of Pennsylvania | https://senatorpennycuick.com | Privacy Policy |