|

||

|

In this Update:

Tracy Talk: Victoria’s LawPennycuick Introduces “SchoolWatch” Bill to Give Taxpayers Access to School Spending Data

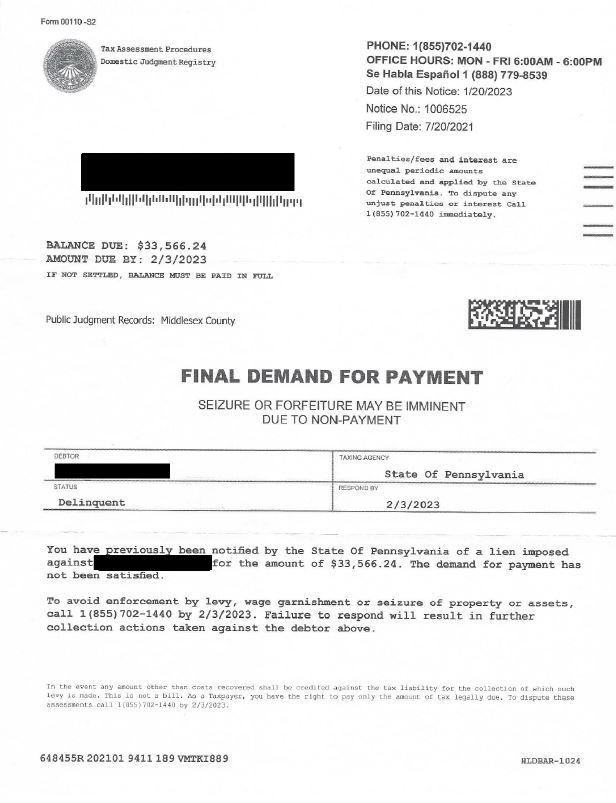

This week, I introduced a “SchoolWatch” bill to give taxpayers access to school spending data. My bill would establish a searchable database providing detailed information such as receipts and expenses of school districts, charter and cyber charter schools, and area vocational-technical schools. It will not result in any new reporting requirements or costs to public schools. Read more about my legislation here: Bill Information – Senate Bill 196; Regular Session 2023-2024 – PA General Assembly (state.pa.us) Tour of New Grand View Health PavilionWith healthcare being a rapid changing industry, we must adapt. Last week, I got the opportunity to tour Grand View Health’s new Health Pavilion. This addition is equipped with all advanced capabilities to help transform healthcare in our community. Through this project, Grand View Health is able to serve more patients and better serve the public in need. A big thank you to all of our health care providers for providing the highest level of care to our community. Your dedication to the healthcare system is truly appreciated. Western Montgomery Career and Technology Center Re: National Career and Technical Education Month February is National Career and Technical Education Month, and this year I celebrated by attending the Career and Technical Education celebration dinner. Joined with me was Pottstown School District’s Director of Career and Technical Education, Theresa Baller, Administrative Director of Western Montco Career and Tech Center, David Livengood, and Representative Joe Ciresi. Thank you for allowing me to celebrate the value of CTE and the achievements and accomplishments of CTE programs across the country. GRCA’s Business & Community Advocacy Council Meeting I met with the GRCA’s Business & Community Advocacy Council on Friday (Feb. 10) to introduce myself and talk about my priorities in the Senate, while listening to the needs of the local business community directly. GRCA serves as a helping hand to our federal, state and local officials to acknowledge the challenges businesses face in hopes to find legislative solutions. Joined with me was Rep. Mark Gillen, Rep. Barry Jozwiak and Director of Government and Community Relations at Greater Reading Chamber Alliance, Katherine Cunfer. I thank you for having me and I look forward to working with Berks business leaders and on legislation that will strengthen our businesses. Presentation of Citation to Lieutenant Jeff KratzIt was a honor to presenting Lieutenant Jeffrey Kratz with a Senate Citation to honor his 36 years of service to Towamencin Township. Lieutenant Kratz joined Towamencin March of 1987. While Lieutenant, he graduated from the prestigious FBI National Academy in September 2009. Congratulations on a standout career and best wishes for your retirement! Scam Warning: Deceptive ‘Final Demand for Payment’ Letters Again Targeting PennsylvaniansWith the tax filing season underway, the Department of Revenue is encouraging Pennsylvanians to be on the lookout for scams that are designed to trick people into turning over sensitive data and personal information. According to the department, the scam notices are sent through the mail from phony entities that closely resemble the name of a collection agency or a state taxing agency. Keep an eye out for dubious claims or suspicious details, including: ➡The phony letters come from “Tax Assessment Procedures Domestic Judgment Registry.” No such entity exists. ➡The letters do not include a return address. A notice from the Department of Revenue will always include an official Department of Revenue address as the return address. ➡The recipient owes the “State of Pennsylvania” unpaid taxes, rather than the Commonwealth of Pennsylvania or Department of Revenue. ➡The phony letters are very generic and do not include any specific information about the taxpayer’s account. Legitimate letters from the Department of Revenue will include specifics, such as an account number and any liability owed, to give the taxpayer as much information as possible. Letters from the Department of Revenue also include more detailed contact information and multiple options to make contact with the department. ➡The phony letters focus on public records, such as tax liens, that anyone can access. Enforcement letters from the Department of Revenue include more detailed information about the taxpayer’s account and any liabilities that are owed. If you believe you are a victim of tax fraud or tax-related identity theft, contact the Bureau of Fraud Detection & Analysis by emailing Ra-rvpadorfraud@pa.gov or calling 717-772-9297. The bureau’s phone line is open from 9 a.m. to 4:45 p.m., Monday through Friday. For more information on ways to protect yourself, visit Revenue’s Identity Theft Victim Assistance webpage. You can also find further information about protecting yourself online at PA.gov/Cybersecurity. For more information please visit, Scam Warning: Deceptive ‘Final Demand for Payment’ Letters Again Targeting Pennsylvanians . How To Donate Any Amount of Your Tax Return To Support Pennsylvania’s Military, Veterans, and Their Families Facing Difficult TimesPennsylvanians filing their 2022 personal state income taxes can help Pennsylvania’s military personnel, veterans and their families by donating any amount of their refund to the state’s Military Family Relief Assistance Program (MFRAP) and/or Veterans’ Trust Fund (VTF). Both programs are administered by the Pennsylvania Department of Military and Veterans Affairs, which provides resources and assistance to veterans, military members, and their families in the Commonwealth. Pennsylvanians interested in donating should refer to the 2022 Pennsylvania Personal Income Tax (PA-40) Instruction Booklet, which includes full instructions on how to donate. “Members of our armed forces, veterans and their families have made extraordinary sacrifices to serve our country – it is important that we work to support them, especially when they fall on hard times,” said Maj. Gen. Mark Schindler, Pennsylvania’s acting adjutant general and head of the DMVA. “The generosity of Pennsylvanians donating to these two important programs has been instrumental in providing financial assistance to military personnel, veterans and their families. Donations of any amount are greatly appreciated and go a long way to help those who have served and sacrificed for our nation.” Military Family Relief Assistance Program: The MFRAP helps Pennsylvania service members and their families by providing financial assistance to those with a direct and immediate financial need as a result of circumstances beyond their control. Examples of how MFRAP grants helped service members in 2022 include the following:

Members of the armed forces who are residents of Pennsylvania are eligible to apply for assistance while they are serving on active duty for 30 or more consecutive days with the Army, Army Reserve, Navy, Navy Reserve, Air Force, Air Force Reserve, Marine Corps, Marine Corps Reserve, Coast Guard, Coast Guard Reserve, Space Force or the Pennsylvania Army or Air National Guard. All members of the armed forces who were discharged for medical reasons are also eligible to apply for assistance up to four years after a medical discharge. Reserve component service members (including Pennsylvania National Guard members) and their families may be eligible for a grant for a period of up to three years after release from a qualifying active-duty tour. The program also applies to certain family members of eligible service members. Applicants must show that they have a direct and immediate financial need as a result of circumstances beyond their control. Since the MFRAP began in 2006, individuals have donated more than $2.17 million through private donations or when filing their Pennsylvania personal income tax returns. In addition to a donation on the state Personal Income Tax form, contributions can be made directly by sending a check to DMVA-MFRAP, Building 9-26 Fort Indiantown Gap, Annville, PA 17003, or online at www.donate.dmva.pa.gov. Donations are tax deductible to the extent authorized by federal law. To learn more about the MFRAP, visit www.mfrap.pa.gov. Veterans’ Trust Fund: The VTF provides funding to assist and support Pennsylvania veterans and their families. The VTF will issue grants to statewide charitable organizations that assist veterans, veterans service organizations and county directors of veterans affairs. The fund can assist veterans in need of shelter and with necessities of living. Since the VTF grant program began in 2013, a total of $5.33 million has been awarded to organizations across Pennsylvania. The VTF is funded by generous Pennsylvanians who voluntarily donate when applying for or renewing driver’s licenses, photo IDs or motor vehicle registrations, purchasing Honoring Our Veterans standard and motorcycle license plate, purchasing Honoring our Women Veterans standard license plate, or making private donations. Private donations can be made online at www.donate.dmva.pa.gov or mailed to: DMVA-Veterans’ Trust Fund, Bldg. 0-47 Fort Indiantown Gap, Annville, PA 17003. To learn more about the VTF, visit www.vtf.pa.gov. For more information about the DMVA, visit us online at www.dmva.pa.gov or follow us at www.facebook.com/padmva or www.twitter.com/padmva. February PHEAA Webinars – Scholarships & PlanningAdvanced Planning for Financing Higher Education 2/7/23 Tuesday Noon; 2/21/23 Tuesday 6:30pm The thought of Higher Education costs can be overwhelming, however planning and identifying what you can do to help lessen those costs is an important step. It’s never too early or too late to start understanding what those costs are and what is available to help maintain, plan and help you make affordable decisions. Join Dan Wray and Linda Pacewicz of PHEAA’s PA Forward Program in a one hour webinar to begin that process and become prepared. Searching for Scholarships and Affording the Balance 2/9/23 Thursday Noon; 2/23/23 Thursday 6:30pm There are many ways to pay for education, and one important step is to search and apply for Scholarships. More free money equals less borrowing. This presentation will review the types of options available, along with tips on applying. It will also offer samples of fun scholarship options to get you started. We’ll then review what to do about the balances that might be left over in order to make affordable higher education decisions. Join Linda Pacewicz and Daniel Wray from Pennsylvania Higher Education Assistance Agency (PHEAA ) for an hour of detailed information on this topic. New Law Targets Growing Number of Fentanyl Overdose Deaths

Fentanyl-laced heroin and counterfeit pills are killing an increasing number of Pennsylvanians. Legislation enacted by the General Assembly is now in effect to prevent overdose deaths by legalizing fentanyl test strips for personal use. Effective Jan. 1, Act 111 of 2022 amended the Controlled Substance, Drug, Device and Cosmetic Act of 1972 to no longer define fentanyl test strips (FTS) as drug paraphernalia in Pennsylvania, making them a legal, low-cost method to prevent drug overdoses. The Pennsylvania departments of Drug and Alcohol Programs, Health, and Human Services, along with the Pennsylvania Commission on Crime and Delinquency, created a survey for substance use disorder stakeholders to gauge demand for FTS while work is underway to make them available across the commonwealth. The survey contains questions on currently available trainings and materials, preferred brands and current distribution methods. You Can Provide Input on Traffic Safety with Online Survey

Motorists have until Feb. 28 to provide input on traffic safety and driving behaviors through an online survey by the Pennsylvania Department of Transportation (PennDOT). In 2021, 1,230 people died on Pennsylvania roadways. Many of these deaths could have been prevented by safer driving. PennDOT works with educational and enforcement grantees to deliver programming each year to help prevent crashes, fatalities and injuries on our roadways. This survey seeks information on motorists’ behavior behind the wheel to help inform program planning. The voluntary questionnaire covers several topics including seat belt use, impaired driving, speeding and distracted driving, as well as bicycle, pedestrian and motorcycle safety. It should take about five minutes to complete and all responses are completely anonymous. You can find information on safe driving here. Help Available to Boost Security at Nonprofits and Religious Institutions

Applications are being accepted for state Nonprofit Security Grants for nonprofit organizations and religious institutions. Administered by the Pennsylvania Commission on Crime and Delinquency, the program provides grants to nonprofit organizations that principally serve individuals, groups or institutions that are included within a bias motivation category for single bias hate crime incidents as identified by the FBI’s Hate Crime Statistics publication. Grant awards can range from $5,000 to $150,000 for a wide variety of eligible items, including: The application period closes March 2. Extra SNAP Payments Set to End

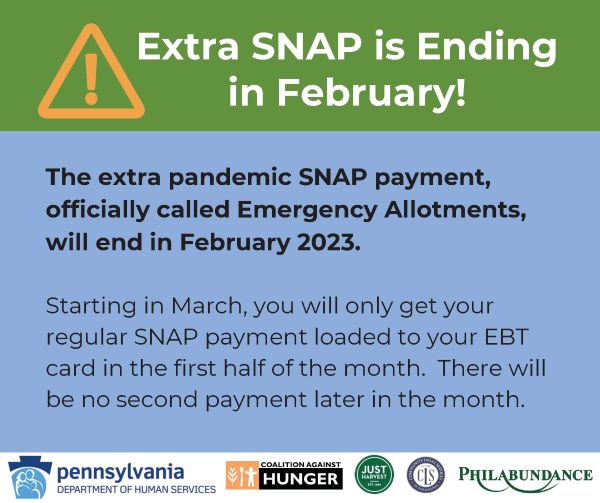

During the COVID-19 emergency, the federal government allowed states to issue additional SNAP food assistance payments that increased the maximum available for households by at least $95 each month. These extra payments will be ending after February and SNAP recipients will only receive one regular SNAP payment starting in March. If you or someone you know needs help, there are food assistance programs available in your community. Visit the Department of Human Services or Department of Agriculture for information on food assistance programs and where to find local resources. Additionally, if recipients currently have extra funds on their cards, they will still be available. SNAP benefits only expire if cards are not used for nine months. To ensure households are receiving the maximum SNAP benefit based on their individual circumstances, Pennsylvanians are encouraged to report changes to their household size, income or expenses online at dhs.pa.gov/COMPASS via the myCOMPASS PA mobile app or by calling 877-395-8930. Veteran Discounts are Available All Year

Some businesses offer discounted prices for military service members and veterans on special days, but many others feature them all year. A list of veteran discounts offered year-round by national businesses is maintained by the U.S. Department of Veterans Affairs. Check local businesses for their participation. It’s a small way to show appreciation for the men and women who served our country, as well as the families they support. 2023 Adult Trout Stocking Schedule Available

The 2023 adult trout stocking schedule is now available. The Pennsylvania Fish and Boat Commission will stock approximately 3.2 million adult trout in 697 streams and 126 lakes open to public angling. The trout stocking schedule is searchable by county, lists the waterways in alphabetical order, and indicates stocking dates, meeting locations for volunteers, and the species of trout that are planned to be stocked at each location. Pennsylvania’s statewide Opening Day of Trout Season is April 1. A single, statewide Mentored Youth Trout Day will take place March 25. Trout to be stocked will include approximately 2.3 million Rainbow Trout, 707,000 Brown Trout and 168,000 Brook Trout. As with past practice, the average size of the trout produced for stocking is 11 inches in length with an average weight of .58 pounds. |

||

|

||

Want to change how you receive these emails? 2026 © Senate of Pennsylvania | https://senatorpennycuick.com | Privacy Policy |